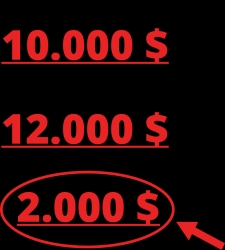

calculation (n)

/ˌkæl.kjʊˈleɪ.ʃən/

tính toán, đo lường

the process of using information you already have and adding, taking away, multiplying, or dividing numbers to judge the number or amount of something

preparation (n)

/ˌprep.ərˈeɪ.ʃən/

sự chuẩn bị

the things that you do or the time that you spend preparing for something

owe (v)

/əʊ/

nợ

to have the responsibility to pay or give back something you have received from someone

fill out (phrasal verb)

/fɪl aʊt/

điền vào

to add information such as your name or address in the empty spaces on an official document

tax incentive (n)

/tæks ɪnˈsen.t̬ɪv/

giảm thuế, ưu đãi thuế

a reduction in taxes that encourages companies or people to do something that will help the country's economy

percent (n)

/pəˈsent/

phần trăm

one part of 100, or a particular amount of a total that you have divided by 100; percent is often shown using the symbol %

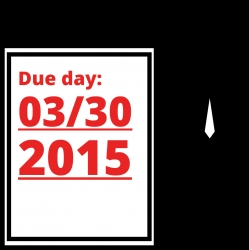

due date (n)

/duː deɪt/

ngày đáo hạn

the date or day that something is supposed to be paid, returned, completed, etc.

corporate income tax (n)

/ˈkɔr·pə·rət ˈɪn·kʌm tæks/

thuế thu nhập doanh nghiệp

tax that a company has to pay on its profits

personal income tax (n)

/ˈpɜr·sə·nəl ˈɪn·kʌm /tæks/

thuế thu nhập cá nhân

a tax paid by people on the money they earn, as opposed to a tax that a company pays on its profits

value-added tax (n)

/ˈvæl·ju ˈæd·ɪd tæks/

thuế giá trị gia tăng

a tax that is added to the price of goods and services

tax return (n)

/ˈtæks rɪˌtərn/

tờ khai thuế, giấy khai thuế

a document on which you report your income each year to calculate your taxes

Hãy đăng ký thành viên và đăng nhập để sử dụng chức năng này!

Hãy đăng ký thành viên và đăng nhập để sử dụng chức năng này!

Bình luận