balance (n)

/ˈbæl.əns/

the amount of money you have in a bank account, or the amount of something that you have left after you have spent or used up the rest

credit card (n)

/ˈkred·ɪt kɑrd/

a small plastic card that can be used as a method of payment, the money being taken from you at a later time

inflation rate (n)

/ɪnˈfleɪ.ʃən reɪt/

the rate at which prices increase over time, causing the value of money to fall

interest rate (n)

/ˈɪn·trəst reɪt/

the percentage amount that you pay for borrowing money, or get for lending money, for a period of time, usually a year

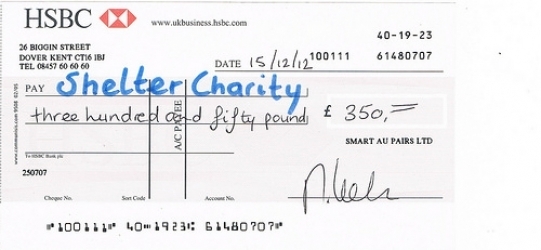

disbursement (n)

/dɪsˈbɜːsmənt/

a large payment of money, for example, from a bank, organization, or government, or the act of making such a payment

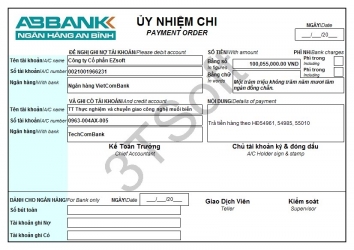

payment order (n)

/ˈpeɪ·mənt ˈɔr·dər/

an order or an instruction of a sender to a receiving bank directing transfer of funds to a designated account or beneficiary

Hãy đăng ký thành viên và đăng nhập để sử dụng chức năng này!

Hãy đăng ký thành viên và đăng nhập để sử dụng chức năng này!

Bình luận